292

points

Questions

0

Answers

38

-

Basic Concepts & Principles of accounting are:

1.Business Entity

A business is considered a separate entity from the owner(s) and should be treated separately. Any personal transactions of its owner should not be recorded in the business accounting book, vice versa.

2. Going Concern

It assumes that an entity will continue to operate indefinitely. In this basis, assets are recorded based on their original cost and not on market value. Assets are assumed to be used for an indefinite period of time and not intended to be sold immediately.

3. Monetary Unit

The business financial transactions recorded and reported should be in monetary unit, such as Indian Rupees,US Dollar, Canadian Dollar, Euro, etc. Thus, any non-financial or non-monetary information that cannot be measured in a monetary unit are not recorded in the accounting books, but instead, a memorandum will be used.

4. Historical Cost

All business resources acquired should be valued and recorded based on the actual cash equivalent or original cost of acquisition, not the prevailing market value or future value. Exception to the rule is when the business is in the process of closure and liquidation.

5. Matching

This principle requires that revenue recorded, in a given accounting period, should have an equivalent expense recorded, in order to show the true profit of the business.

6. Accounting Period

This principle entails a business to complete the whole accounting process of a business over a specific operating time period. It may be monthly, quarterly or annually. For annual accounting period, it may follow a Calendar or Fiscal Year.Normally it starts with 1st April and ends on 31st March.

7. Conservatism

This principle states that given two options in the valuation of business transactions, the amount recorded should be the lower rather than the higher value.

8. Consistency

This principle ensures consistency in the accounting procedures used by the business entity from one accounting period to the next. It allows fair comparison of financial information between two accounting periods.

9. Materiality

Ideally, business transactions that may affect the decision of a user of financial information are considered important or material, thus, must be reported properly. This principle allows errors or violations of accounting valuation involving immaterial and small amount of recorded business transaction.

10. Objectivity

This principle requires recorded business transactions should have some form of impartial supporting evidence or documentation. Also, it entails that bookkeeping and financial recording should be performed with independence, that’s free of bias and prejudice.

11. Accrual

This principle requires that revenue should be recorded in the period it is earned, regardless of the time the cash is received. The same is true for expense. Expense should be recognized and recorded at the time it is incurred, regardless of the time that cash is paid.

- 1446 views

- 1 answers

- 0 votes

-

If you’re stuck with a medical bill that’s more than you can afford to repay in cash, a credit card that’s designed specifically for health-care expenses may help you quickly fill the gap.Care credit Card is simply medical credit card.Financing Options/Rate of interest may vary.

- 1078 views

- 1 answers

- 0 votes

-

Disadvantages of a manual accounting system:

- More time consuming

- Prone to human error

- Longer to generate reports

- More suited to smaller businesses

- Records susceptible to perils such as fire and water

- Not particularly suited to environments where there are a large volume of transactions

- 1014 views

- 1 answers

- 0 votes

-

An asset entry recorded on the balance sheet of a business that has value to the business, but is neither a real asset nor has a resale value. e.g. prepayments or deferred revenue.

- 1071 views

- 2 answers

- 0 votes

-

A general ledger is the master set of accounts that summarize all transactions occurring within an entity.

The general ledger contains a debit and credit entry for every transaction recorded within it, so that the total of all debit balances in the general ledger should always match the total of all credit balances. If they do not match, the general ledger is said to be out of balance, and must be corrected before reliable financial statements can be compiled from it.

- 1156 views

- 2 answers

- 0 votes

-

Accounts receivable is the money that a company has a right to receive because it had provided customers with goods and/or services. For example, a manufacturer will have an account receivable when it delivers a truckload of goods to a customer on June 1 and the customer is allowed to pay in 30 days. From June 1 until the company receives the money, the company will have an account receivable (and the customer will have an account payable). Accounts receivables are also known as trade receivables.

- 839 views

- 1 answers

- 0 votes

-

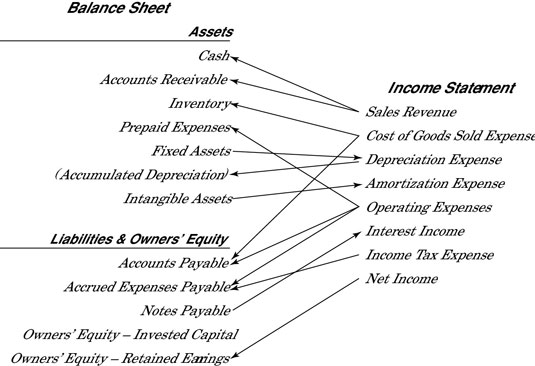

The following figure shows the lines of connection between income statement accounts and balance sheet accounts. When reading financial statements, in your mind’s eye, you should “see” these lines of connection.

Connections between income statement and balance sheet accounts.

Connections between income statement and balance sheet accounts.Here’s a quick summary explaining the lines of connection in the figure, starting from the top and working down to the bottom:

-

Making sales (and incurring expenses for making sales) requires a business to maintain a working cash balance.

-

Making sales on credit generates account receivable:

-

Selling products requires the business to carry an inventory (stock) of products.

-

Acquiring products involves purchases on credit that generate accounts payable.

-

Depreciation expense is recorded for the use of fixed assets (long-term operating resources).

-

Depreciation is recorded in the accumulated depreciation contra account (instead decreasing the fixed asset account).

-

Amortization expense is recorded for limited-life intangible assets.

-

Operating expenses is a broad category of costs encompassing selling, administrative, and general expenses:

-

Some of these operating costs are prepaid before the expense is recorded, and until the expense is recorded, the cost stays in the prepaid expenses asset account.

-

Some of these operating costs involve purchases on credit that generate accounts payable.

-

Some of these operating costs are from recording unpaid expenses in the accrued expenses payable liability.

-

-

Borrowing money on notes payable causes interest expense.

-

A portion (usually relatively small) of income tax expense for the year is unpaid at year-end, which is recorded in the accrued expenses payable liability.

-

Earning net income increases retained earnings.

- 824 views

- 1 answers

- 0 votes

-

-

The provision for doubtful debts is identical to the allowance for doubtful debts.The provision is the estimated amount of bed debt that will arise from accounts receivable that have been issued but not yet collected. A business typically estimates the amount of bad debt based on historical experience, and charges this amount to expense with a debit to the bad debt expense account (which appears in the income statement) and a credit to the provision for doubtful debts account (which appears in the (balance sheet.)

The provision is used under accrual basis accounting, so that an expense is recognized for probable bad debts as soon as invoices are issued to customers, rather than waiting several months to find out exactly which invoices turned out to be uncollectible.

- 914 views

- 1 answers

- 0 votes

-

- Meaning: Stocks are simply share of company while bonds represent debt.

- Priority of repayment. In the event of the liquidation of a business, the holders of its stock have the last claim on any residual cash, whereas the holders of its bonds have a considerably higher priority, depending on the terms of the bonds. This means that stocks are a riskier investment than bonds.

- Periodic payments. A company has the option to reward its shareholders with dividends, whereas it is usually obligated to make periodic interest payments to its bond holders for very specific amounts.

- Voting rights. The holders of stock can vote on certain company issues, such as the election of directors. Bond holders have no voting rights.

- 1295 views

- 2 answers

- 0 votes

-

In finance, a bond is a debt security, in which issuer owes the holders a debt and is obliged to repay the principal and interest.It is more secure than shares.

- 3461 views

- 7 answers

- 0 votes